Finance

financial analysis. Advanced topics include financial engineering, forensic accounting, and asset pricing....

Earn Your Degree

Most Popular Courses

Top Rated Courses

Best of Finance & Economics Courses from the World's Top Instructors

Financial Literacy for Informed Decisions

Accelerated Introduction to Managerial & Financial Accounting

Launch Your Career

Join the Fintech Revolution

Most Popular Certificates

Investment Management Practices and Trends

Recently Launched Guided Projects

Get a Head Start on Your Degree Today

Master Quantitative Finance

Skills for Finance

Frequently Asked Questions about Finance

There are many great free finance courses available online. Learn valuable knowledge like how women access sensitive capital with the Learn About 10K Women course. Or, explore the behavioral trends in finance with Explore Behavioral Finance with Duke course. Get a better understanding of corporate strategy with Master Corporate Strategycourse. Get the know-how on econometrics with Erasmus University's Enhance Your Econometrics Knowledge course. Lastly, explore how to assess and manage risk on the Develop Advanced Valuation and Strategy Skills course.

If you're just starting out in finance, Coursera has great courses to get you up and running. For a broad overview, Finance for Non-Finance Professionals provides a comprehensive introduction to finance and financial markets. To dive deeper into investing, Financial Markets: A Global Perspective will give you the basics of tradable assets and investment strategies. To understand the cutting-edge of finance, check out Fintech: Foundations, Payments, and Regulations and Risk and Return: A Valuation Approach to gain skills in valuation. Finally, Value and Business Decision Making will teach you the fundamentals of making sound business decisions.

If you're looking to enhance your knowledge in finance and gain valuable skills, consider taking one of the best advanced finance courses, such as Advanced Valuation and Strategy, Advanced Financial Reporting, Design and Innovation of Business Models, Advanced Methods in Reinforcement Learning for Finance, and Interest Rate Models. Each course covers the fundamentals of advanced finance in an easy to understand manner and provides you with the latest concepts needed to stay ahead in this field.

We all use money and manage our personal finances, but what does it mean to study finance in a business context? Corporate finance encompasses the process of acquiring needed funding as well as how that funding is managed and allocated within an organization.

In terms of day to day operations, that means knowing proper accounting and bookkeeping practices to accurately track cash flows in and out of different business areas, and managing the company balance sheet to ensure the lights stay on. In the bigger picture, finance expertise is critical for planning any business funding strategy, regardless of the mix of cash, debt, and equity investors and equity sources like venture capital, private equity, or even an IPO.

While money may be the ultimate fungible commodity, careers in finance aren’t as interchangeable as some people think! Traditional jobs in finance include accountants and certified public accountants (CPAs), controllers, actuaries, bankers, and financial planners, and these services are always in demand. Higher up the ladder, most large corporations have a chief financial officer (CFO) in the C-suite.

Just as the world of finance is evolving, so are fast-growing careers in this field. For example, environmental accountants provide guidance at the intersection of the environment and business, with responsibilities such as determining compliance costs for regulations and identifying cost-saving environmental initiatives. Forensic accountants are the detectives of the financial world, with responsibility for “following the money” in cases of corporate fraud, corruption, organized crime, and increasingly complex financial crimes.

Regardless of what type of career you want to pursue, investing in your education can help you get there.

Online courses and short Guided Projects are a great way to take your career in finance to the next level, no matter where you’re starting. If you’re just getting started, you can take entry-level courses on the fundamentals of accounting, banking, microeconomics, corporate finance, financial planning, and more. For more advanced learners, courses in topics like taxation, risk management, and fintech and digital transformation in financial services can help you add more specialized skills to your toolkit. You can even pursue a full-fledged master’s degree in accounting online from a top-quality university!

Finance courses on Coursera cover a broad spectrum of essential skills, tailored for a diverse range of learners—from beginners to advanced professionals:

- Fundamental concepts in personal finance, including budgeting and investing

- Core principles of corporate finance, such as financial analysis and forecasting

- Advanced techniques in financial modeling and valuation

- Understanding global financial markets and how they operate

- Practical applications of fintech innovations in banking and finance

- Ethical considerations and regulatory compliance in financial decisions

- Risk management strategies and tools to mitigate financial exposure

No prior experience in finance is required to begin entry-level courses on Coursera. The courses are designed to help learners at various stages of their educational journey:

- Beginners can start with introductory courses that lay the groundwork for basic financial concepts.

- Intermediate learners can delve into more specific topics such as investments, banking, or fintech.

- Advanced courses are available for professionals aiming to enhance their expertise in areas like quantitative finance, portfolio management, or financial regulations.

Coursera offers a range of finance-related credentials to fit various career goals:

- Professional certificates that validate your skills in finance fundamentals and specialized areas.

- Specialized course certificates that highlight specific skills such as financial analysis or fintech applications.

- Certifications developed in partnership with leading financial institutions and global finance organizations.

- These credentials can bolster your resume and demonstrate your commitment and expertise in the field of finance.

Gaining skills in finance through Coursera can open up numerous career paths across industries, including:

- Financial Analyst or Advisor, providing insights and guidance on investments

- Corporate Finance Manager, overseeing financial operations and strategies within companies

- Investment Banker, facilitating large financial transactions and mergers

- Fintech Developer, creating technology-driven financial tools and platforms

- Risk Management Specialist, identifying and mitigating financial risks

Online Finance courses offer a convenient and flexible way to enhance your knowledge or learn new Finance skills. Choose from a wide range of Finance courses offered by top universities and industry leaders tailored to various skill levels.

When looking to enhance your workforce's skills in Finance, it's crucial to select a course that aligns with their current abilities and learning objectives. Our Skills Dashboard is an invaluable tool for identifying skill gaps and choosing the most appropriate course for effective upskilling. For a comprehensive understanding of how our courses can benefit your employees, explore the enterprise solutions we offer. Discover more about our tailored programs at Coursera for Business here.

Other topics to explore

What Coursera Has to Offer

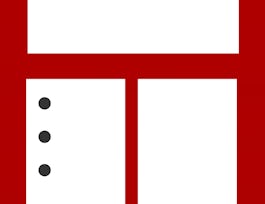

| Learning program | Description |

|---|---|

Guided Project | Learn a job-relevant skill that you can use today in under 2 hours through an interactive experience guided by a subject matter expert. Access everything you need right in your browser and complete your project confidently with step-by-step instructions. |

Project | Learn a new tool or skill in an interactive, hands-on environment. |

Course | Take courses from the world's best instructors and universities. Courses include recorded auto-graded and peer-reviewed assignments, video lectures, and community discussion forums. When you complete a course, you’ll be eligible to receive a shareable electronic Course Certificate for a small fee. |

Specialization | Enroll in a Specialization to master a specific career skill. You’ll complete a series of rigorous courses, tackle hands-on projects, and earn a Specialization Certificate to share with your professional network and potential employers. |

Professional Certificate | Whether you’re looking to start a new career or change your current one, Professional Certificates on Coursera help you become job ready. Learn at your own pace from top companies and universities, apply your new skills to hands-on projects that showcase your expertise to potential employers, and earn a career credential to kickstart your new career. |

MasterTrack® Certificate | With MasterTrack® Certificates, portions of Master’s programs have been split into online modules, so you can earn a high quality university-issued career credential at a breakthrough price in a flexible, interactive format. Benefit from a deeply engaging learning experience with real-world projects and live, expert instruction. If you are accepted to the full Master's program, your MasterTrack coursework counts towards your degree. |

Degree | Transform your resume with a degree from a top university for a breakthrough price. Our modular degree learning experience gives you the ability to study online anytime and earn credit as you complete your course assignments. You'll receive the same credential as students who attend class on campus. Coursera degrees cost much less than comparable on-campus programs. |